After a difficult year for travel in 2020, the industry has seen a steady, but slow rise in domestic and international travel. By the end of 2021, many borders reopened and entry restrictions loosened.

With all of the optimism going into 2022, how has the industry performed so far? Onyx has been the exclusive payments data contributor to the Skift Travel Health Index and has assisted in monitoring recovery trends since the Index’s inception. We’ve reviewed performance for the first 6 months of 2022 and outlined 5 key takeaways.

Recovery in the Skift Travel Health Index has risen steadily in the first half

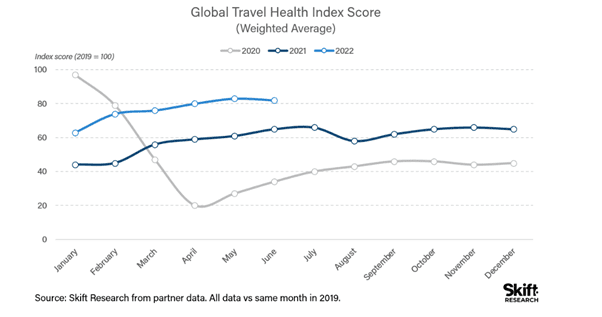

The Skift Travel Health Index was launched in May 2020 as a real-time measure to track the health of the travel industry beyond the impact of the Covid-19 pandemic. The base indicator is 100 points, providing a score relative for the same month in 2019. The points are determined by numbers for global and domestic travel, retail sales, hotel and short-term rental occupancy and air travel.

At the beginning of 2022 the Global Index Score was 65 points, still 35 points below January 2109 levels. While the number wasn’t great, it was stronger than the 44 points scored in January 2021. With the opening of more borders, February saw the strongest month of recovery since the pandemic started, jumping 9 percentage points to an impressive 74 points. March saw little progress due to the war in Ukraine and China’s still locked borders, but in North America the Travel Health Index had risen from 78 in January to 96 points – just below the 2019 level. April and May saw a return to ‘traditional’ levels of demand, reaching 81 points by the end of May, and also saw seven countries (Brazil, France, India, Italy, Mexico, Turkey and UAE) join the ‘100’ club, where travel was back to 2019 levels.

Surprisingly in June, and for the first time since January, the Skift Travel Health Index dropped one point. The number may seem small, but it is significant in that economic worries, mass cancellations at airports and price hikes seem to be catching up with the industry. The summer months usually mean increased travel, and with U.S. recently removing testing requirements to enter the country, one might expect the index will rise again next month.

Hotel prices rise

Despite rising hotel ADR during recovery, global occupancy rates have gone up in the global occupancy rates have gone up in the past six months. By May, published hotel rates were above 2019 levels for almost every country, and there seems to be no sign of high prices decreasing. Bloomberg reports that hotel prices increased by around 33% across the U.S. over the past year. However, in some major cities, the price hikes are much higher. For example, the average hotel price for a hotel room in Chicago in June was $361 — a 93.6% hike from the previous year.

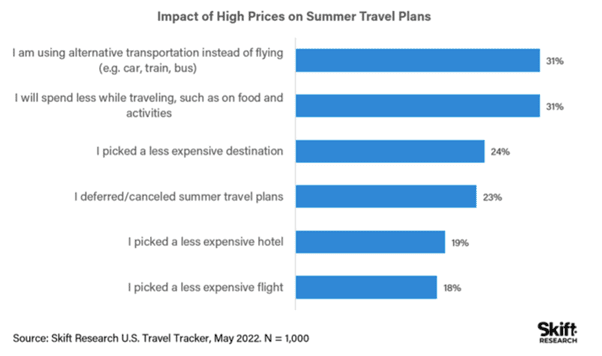

These high prices are also starting to have a real impact on decisions being made by travelers. A recent survey by Skift Research found that almost three-quarters said that because of the rising prices they were reconsidering their travel plans. While 23% of respondents said they were canceling or deferring their summer travel plans completely, most people still plan to travel but are considering choosing cheaper alternatives for their transportation and accommodation.

City or countryside?

At the start of the pandemic many cities around the world were in lockdown, so people began flocking to rural beaches and towns, choosing space and seclusion overcrowded city centers, indoor activities and public transportation. But in recent months there has been increasing signs that cities are finally starting to come back. Airbnb’s CEO Brian Chesky recently commented that urban demand on the platform is now back above 2019 levels.

According to Airbnb, Dubai has been the most popular destination for hotel searches with more than double the searches compared to 2019 for the past three months.

At the other end of the scale, search levels for the U.S. cities New York and Los Angeles are still below pre-pandemic levels. But interestingly, business travel to cities is rebounding more than expected. There was much talk that virtual meetings would permanently shrink the need for business travel, but American Airlines, a major carrier at LaGuardia and JFK airports, recently told investors that business travel had reached 80% of 2019 levels and would soon reach 90%.

Impact of Omicron

Not surprisingly when Omicron first hit there was a notable impact on travel performance, with Latin America’s travel score impacted most. However, most regions are showing a quick rebound, with Europe, the Middle East and Africa the slowest to recover, but still registering scores above the pre-Omicron performance within two months.

With the reduction in covid cases many countries which had their borders closed are now opening up. Included in that list is Indonesia, Thailand, and Singapore, which have bounced back quickly and are performing well. At the end of February and early March, Singapore allowed fully vaccinated travelers back in from a select few countries but is now open to almost all countries. Thailand and Indonesia followed soon after by easing their rules around testing upon entry.

The complexities and impact of air travel

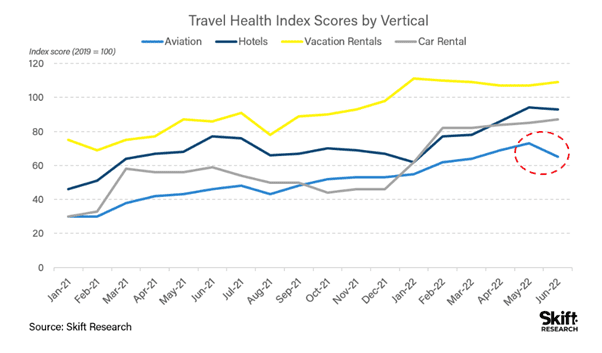

Looking at the data for overall growth in the travel & hospitality sector during the first three months of the year, the most substantial growth came predominantly from air travel. While recovery stalled in the vacation rentals, hotels, and car rental sectors, air travel grew its score from 59 to 62, compared to a baseline of 100 in 2019.

Delta Airlines CEO Ed Bastian noted during the company’s Q1 2022 earnings call that, ‘As Omicron receded, we saw a surge in demand.” He expanded on this further during a CNBC interview, explaining that March was Delta’s best month ever for bookings made for travel in March and beyond.

However, by June there was a sharp decline, caused by major staff shortages, especially at airports, resulting in high levels of forced flight cancellations. Data from OAG (Official Airline Guide) shows how scheduled seats in airplanes have dropped in almost all countries. In Asia there is still lingering uncertainty about travel requirements, while in Europe airports have been unable to process the passenger and baggage flows. The bad press is also having an impact on flight searches, with data from Amadeus, Skyscanner, and Sojern showing a considerable drop from 68 percentage points globally in May to 42 percentage points in June compared to 2019 levels. Europe dropped a full 40 percentage points from 107 (indicating that flight searches in May 2022 were higher than in May 2019) to 67.

So, what will the next six months bring? Travelers will continue to drive demand, while business travel is set to take off. Domestic business (U.S.) is at 81% of pre-pandemic levels and is expected to reach 96% in 2023. And, as of June, 89% of companies are now allowing non-essential domestic business travel. Some questions that remain: will the airlines and airports be able to handle the uplift in capacity? Will hotel rates level off?

While the top priority for many hotels post COVID recovery is revenue, it is beneficial to keep an eye on market trends like those encompassed in the Skift Travel Health Index. The result can be more depth of insight for understanding current and future business trends.

Find out how Onyx’s commission processing solution CommPay can help hotels identify and target their preferred agency partners through booking data by contacting us today.