The global travel rebound is no longer a headline — it’s a reality. But behind the sweeping recovery lies a more nuanced transformation: the world’s luxury travel epicenter is quietly shifting east.

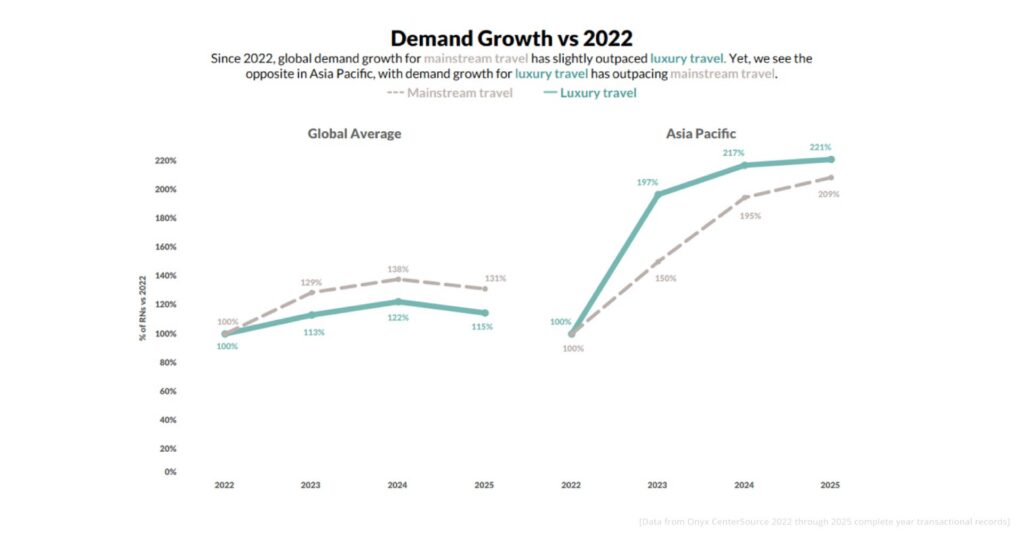

Onyx CenterSource data, drawn from millions of agency-to-hotel transactions, reveals that Asia Pacific (APAC) is leading global luxury travel growth—outpacing not only its own pre-pandemic trajectory but also the global averages for standard travel. For this analysis, “luxury travel” means agency-booked commissionable stays at hotels classified as Luxury on the STR chain scale. Between 2022 and 2025, luxury room nights in APAC surged by more than 90%. That inversion is significant: for the first time in recent history, luxury travel demand in APAC is outstripping mainstream travel.

Luxury Growth with a Purpose

What makes the APAC surge distinct isn’t just its scale — it’s who’s driving it. Traditional Western luxury markets like Europe and North America have plateaued as travelers seek value, sustainability, and quieter indulgences. In contrast, Asia’s emerging affluent class — spanning India, Thailand, Indonesia, and Japan — is powering a wave of high-end bookings centered on experiences and exclusivity rather than excess.

Hotels, too, have adapted quickly. Across Asia Pacific, leading luxury chains are strengthening their ties not only with premium Travel Management Companies (TMCs) and large agencies but also with independent contractors and luxury travel advisors who cater to high-net-worth travelers. Together, these partners are being integrated into performance-based commission models and strategic preferred-supplier programs that go beyond rewarding pure volume or market share. Instead, they emphasize conversion quality, client loyalty, and long-term relationships — perfectly aligning with the expectations of today’s post-pandemic luxury traveler, who values reliability, personalization, and trusted expertise.

Onyx data shows that while global travel is steadily expanding, Asia Pacific’s luxury segment has exploded. The region’s luxury room nights have nearly doubled the growth rate of global averages, signaling a structural shift in how high-value travelers are redistributing global demand.

Different Markets, Shared Momentum

Even within APAC, not all countries are growing equally. Onyx’s breakdown of the top five luxury markets — Australia, India, Japan, Thailand, and Indonesia — highlights that while Australia’s luxury share remains strong, India and Thailand are catching up fast.

Commissionable ADRs have soared across these markets, particularly in Japan and Thailand, where high-end travelers are fueling strong ADR premiums and healthy yield ratios. The spread between standard and luxury yields, however, also reveals where hotels are exercising negotiation power, securing better terms with agencies that bring premium clientele.

Negotiating Power Has Shifted

As travel demand surges across Asia Pacific, hotels now hold stronger negotiating power when it comes to commissions. With occupancy levels rising, hotels no longer need to rely as heavily on generous commission incentives to attract bookings. This shift is most visible in the wider-market segment, where agencies, TMCs, independent contractors, and luxury travel advisors are seeing tighter commission terms and fewer performance-based rewards than before.

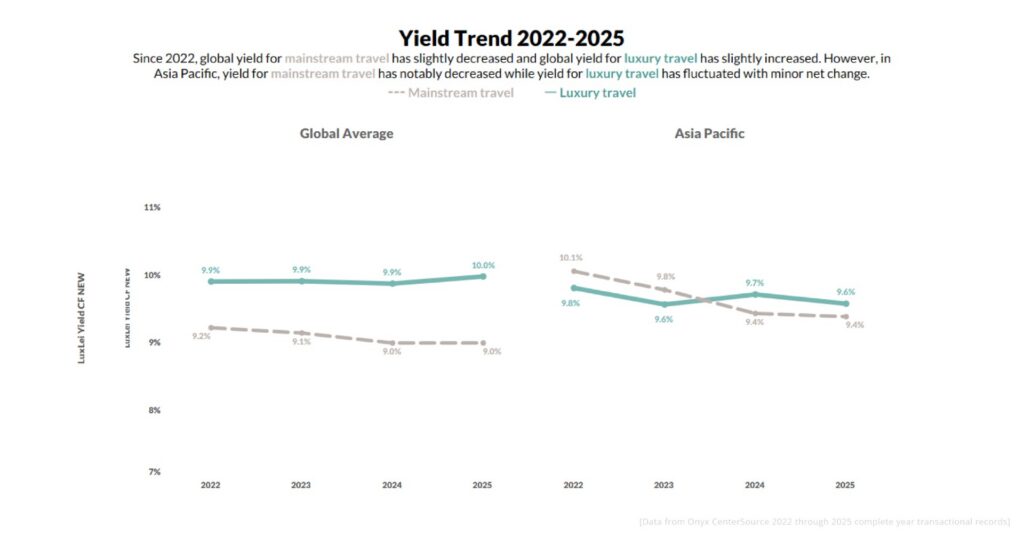

This is reflected in the data: the yield for wider-market travel has dropped nearly one percentage point since 2022, while luxury yield has remained stable. In other words, commission structures are evolving to reward high-value, low-risk luxury bookings over high-volume standard ones.

Several factors explain why wider-market yields are slipping while luxury yields remain steady — most of them tied to how post-pandemic demand and booking behavior have reshaped hotel–agency dynamics.

- Room rates went up faster than commissions.

As hotels raised prices to capture booming demand, the commission percentages didn’t always increase at the same pace. This means agencies earned more in dollars but less when measured as a share of revenue — pulling the yield down. - More short, price-sensitive trips.

Standard travel now includes a higher share of short business trips and budget-conscious bookings. These stays often carry lower commission rates or have stricter payment rules, dragging the overall yield down. - Hotels tightened commission policies.

To protect margins, many hotel groups adjusted their programs — lowering base commissions for standard bookings while keeping luxury rates steady. The luxury segment remained a priority because it brings longer stays and higher-value guests. - More direct bookings and loyalty rates.

Standard travelers are more likely to book directly through hotel websites or loyalty apps that don’t pay commissions, which further reduces the average yield agencies see on the remaining bookings. - Performance-based programs favor luxury agencies.

Luxury agencies tend to meet the higher performance targets tied to bonus commissions — such as conversion, spend per booking, and low cancellation rates. Standard agencies struggle to hit these metrics consistently, so they see fewer overrides.

Together, these factors explain why yield for wider-market travel continues to decline while luxury yield appears steadier. The luxury segment isn’t immune to price competition or policy shifts, but its recovery is being fueled by pent-up post-pandemic demand and sustained high-spend traveler activity, especially in Asia Pacific markets that reopened later than others. As a result, luxury yields have softened less dramatically — supported by strong ADRs, longer booking windows, and deeper agency-hotel partnerships that help absorb market fluctuations.

A Redefined Luxury Economy

The APAC luxury travel surge isn’t just a rebound; it’s a realignment of global travel economics. For decades, luxury travel was anchored in Western corridors — Parisian boutiques, Amalfi villas, or Caribbean resorts. Today, it’s Bangkok rooftops, Kyoto ryokans, and the Maldives’ private atolls commanding both the traveler’s wallet and the industry’s attention.

Countries like Thailand, India, and Japan now lead APAC’s luxury performance, combining rising ADRs with improving yields and payment reliability. The interplay of aspirational travelers and data-savvy hoteliers is creating a more transparent, performance-based luxury ecosystem — one that rewards efficiency as much as elegance.

Onyx Take: Trust Is the True Luxury

As luxury travel matures in Asia Pacific, the conversation is shifting from opulence to operational excellence. The next luxury battleground won’t be fought over who can offer the most exclusive experiences to travelers— but over who pays, performs, and partners the best with travel agencies.

In an era where 94% growth in luxury travel demand meets tightening yield margins, the ultimate differentiator will be trust: trust between travelers and agents, agents and hotels, and hotels and their data. And in that trust equation, clarity of commissions and speed of payments are no longer back-office functions — they’re brand-defining experiences.